Direct Compensation for Property Damage (DCPD) Alberta

Your guide to DCPD in Alberta

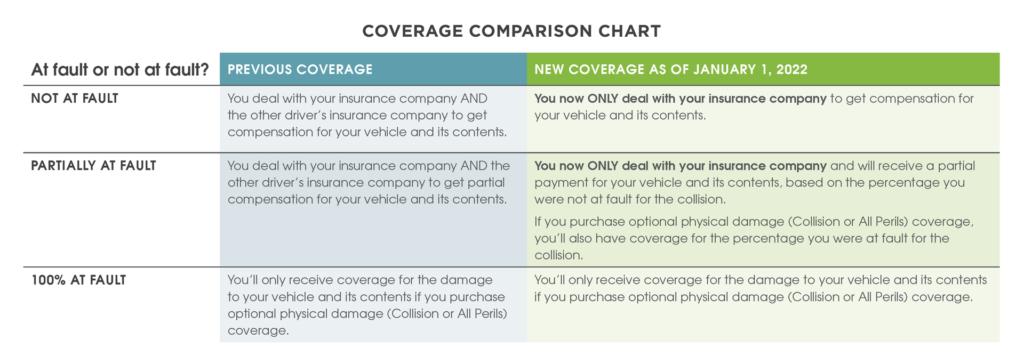

The Alberta Government has passed changes that introduce Direct Compensation for Property Damage (DCPD) coverage to all automobile insurance policies throughout the province effective January 1, 2022.

This legislation is part of the Automobile Insurance Reforms that were announced in October 2020 with the goal of improving Alberta’s auto insurance system and keeping premiums reasonable for consumers.

This change is intended to provide you with more efficient processing of vehicle damage claims as you will no longer need to work with another party’s insurer in the event of an accident. You will always work directly with your own insurer.

NEW DCPD News Bulletins:

DCPD Bulletin Determining Fault

DCPD Bulletin Determining Fault When Turning Left

DCPD Quick Guide!

- DCPD is a mandatory auto insurance coverage that came into effect automatically January 1, 2022 in Alberta

- DCPD applies to not at-fault collisions between two vehicles

- If you are not at-fault in a collision, your insurance company will cover damages to your vehicle caused by another driver

- Making a DCPD claim may or may not affect your premium. In many cases if you are 100% not at-fault in an accident, making a DCPD claim will not affect your premium. In other cases the answer is less clear (see FAQ for more information).

- DCPD is a more efficient system for everyone. It will result in quicker vehicle repairs since you won’t be waiting on someone else’s insurance company.

- DCPD applies to vehicle damage only and not injuries incurred in a collision

- DCPD does not apply to collisions involving uninsured vehicles or hit-and-runs. It does not apply to the at-fault portion of any collision. Optional collision coverage can be purchased for these scenarios.

Find out how DCPD will affect you! Call CMB Insurance at 780.424.2727 or click below to get a quote.

DCPD FAQs

What is Direct Compensation for Property Damage (DCPD)?

- DCPD is a mandatory coverage that applies to your not at-fault portion of a collision between two vehicles.

- The introduction of DCPD in Alberta does not change the automobile coverage, only who pays for the damage.

- If your vehicle is involved in a collision and you are not-at-fault, your vehicle damage will be paid for by your DCPD coverage rather than by another person’s insurance company.

- If your vehicle is considered partially at-fault, then the not-at-fault portion will be paid by your DCPD and your at-fault portion will be paid by your collision coverage (if purchased).

What are the benefits of moving to DCPD in Alberta?

- DCPD is a more streamlined process that provides the advantage of dealing with your own insurer to process your claim resulting in:

-

- Better service

- Receiving compensation quicker so your vehicle can be repaired with less delay

- DCPD is one of the insurance reforms that will help to stabilize premiums for the long term by reducing costs associated with subrogation (the process insurers use to determine who pays for a claim following an accident)

Do I need to do anything to ensure I have DCPD coverage?

No. These changes took effect January 1, 2022, regardless of your insurance renewal date and will be reflected in your new policy documents when they are sent at renewal time.

What does DCPD cover?

- DCPD covers your vehicle damage, damage to contents and loss of use in the event you are not at-fault for an accident (or a portion of the repairs based on the percentage you are not at-fault).

What happens if I’m at fault in an accident?

If you are at-fault in an accident then your collision coverage (if you have it) will cover the costs for damage to your vehicle. If you don’t have collision coverage you will pay these expenses out-of-pocket. This is the same as the previous system.

If you are 50% at-fault then you will pay 50% of the damages either through your collision coverage or out-of-pocket and 50% (the not-at-fault portion) will be paid through your DCPD coverage.

Any medical or rehabilitation expenses will be covered by your Accident Benefits regardless of who is at fault.

Will the at-fault driver be held accountable even though my policy pays for the damage they caused?

Yes, the at-fault driver will always be held accountable. Even though your insurer pays for your loss, the at-fault driver will have the accident added to their driving record.

Will making a DCPD claim affect my premium?

In many cases – particularly for personal auto insurance – if you are 100% not at-fault in an accident, making a DCPD claim will not affect your premium. In other cases – especially commercial auto insurance – the answer is less clear. For specific inquiries please contact us! We are working hard to assist you, our customer, with all the implications DCPD has and to serve you the best way we can.

Can I still sue for damages with DCPD?

Yes, DCPD only applies to damage to the vehicle and its contents, it does not cover other damages such as injuries or additional property damage.

DCPD does not prevent drivers from pursuing legal action for other damages.

Do other Canadian provinces have this kind of Car Insurance?

Yes. DCPD coverage is already used in several provinces, including: Ontario, Quebec, Nova Scotia, New Brunswick, Newfoundland and Prince Edward Island.

How is fault determined in a collision?

DCPD Regulation helps determine the degree of fault for the collision. Your insurers claim representative will use these regulations as well as information about the accident to assess responsibility. This information is gathered from sources such as statements from other drivers, witnesses or passengers as well as police reports and estimators.

See examples of how DCPD regulation works in various accident scenarios:

Does DCPD coverage have a deductible?

DCPD coverage automatically comes with no deductible. It may be possible to add one to your policy.

Find out how DCPD will affect you! Call CMB Insurance at 780.424.2727 or click below to get a quote.