Insurance Product Types

We will assess your risks and put together a package of insurance products that suit your needs so you can be confident you have the right protection.

Surety Bonds

When you take on a significant size job and are required to put some sort of collateral as a guarantee for the party hiring you that the job will be done, you can post a bond rather than putting up funds as collateral.

Crime Insurance

Crime Insurance protects against the loss of assets, such as money and securities resulting from robbery, burglary or theft.

Cyber Insurance

Cyber Insurance protects your company from the fallout of cyber criminals infiltrating or stealing your business data.

Directors and Officers (D&O) Liability Insurance

Directors and Officers (D&O) Liability Insurance protects executives of public, private and non-profit organizations from costly legal actions if they are named in a claim or lawsuit.

Errors and Omissions (E&O) Insurance

Errors and Omissions Insurance provides a business with protection if a mistake is made while delivering professional services such as giving advice or providing contracting services. It is also known as Professional Liability Insurance.

Accounts Receivable Insurance

Accounts Receivable Insurance protects your business when you can’t collect payment for reasons beyond your control.

Automobile Liability Insurance

Automobile Liability Insurance covers expenses to do with injuring someone else or damaging someone else’s property during an accident.

Automobile Physical Damage Insurance

Automobile Physical Damage Insurance includes types of insurance that protect your vehicle if it is damaged either in a collision (eg: Collision insurance), or by something else – including being stolen (eg: Comprehensive insurance).

Builders’ Risk Insurance

Builders Risk Insurance covers property during construction. This can include property at off-site storage or in transit as well.

Business Income with Extra Expense Insurance

Business Income Insurance covers the net income, plus normal continuing operating expenses of a business during a period in which it is unable to operate as usual (such as due to fire damage). Extra Expense Insurance covers expenses incurred to avoid or minimize the amount of time the business is out of operation.

Business Interruption Insurance

Business Interruption Insurance covers lost income if a company has to vacate its location due to damage caused by a disaster, such as a fire. This policy also covers operating expenses, such as electricity, that continue even though your business activities are on hold. It includes policies like Business Income with Extra Expense Insurance (see above).

Business Personal Property Insurance

Business Personal Property Insurance covers movable items owned by a business, such as office supplies, furniture, computers and other equipment.

Commercial Auto Insurance

Commercial Auto Insurance provides protection for vehicles with business, commercial, or public use and includes coverage for injuries as well as damage to vehicles and property. It also covers employees operating their own vehicles for business purposes (such as couriers).

Commercial General Liability Insurance

Commercial General Liability Insurance offers coverage for damage or injury caused by a business’s operations or products, or on its premises.

Commercial Property Insurance

Commercial Property Insurance covers a commercial building and its contents from losses such as fire and theft. It may also cover any resulting impact to business income or increase in expenses.

Completed Operations Insurance

If a product or service you provide causes property damage or bodily injury after completion, Completed Operations Insurance can cover the cost of damages.

Computers Insurance

Computers Insurance provides coverage for loss or damage of data, in addition to theft, loss, vandalism, and accidental damage to computers.

Contractor’s Equipment Insurance

Contractor’s Equipment Insurance (aka Equipment Floater Insurance) is a type of property insurance that covers damage or loss of equipment or tools when they are moved from one place to another.

Employee Dishonesty Insurance

Employee Dishonesty Insurance is a type of crime coverage that helps you recover inventory and revenue if an employee jeopardizes your business.

Employment Practices Liability Insurance (EPLI)

EPLI covers wrongful acts, such as wrongful termination, discrimination, sexual harassment and retaliation. This insurance may also protect your business from other employee-related claims, such as deprivation of a career opportunity, defamation, invasion of privacy, failure to promote, and negligent evaluation.

Pollution Liability Insurance

Pollution liability insurance, also known as environmental liability insurance, provides coverage for the costs associated with pollution conditions resulting from your business operations.

Equipment Breakdown Insurance

Equipment Breakdown Insurance protects against breakdown of equipment by covering the cost to replace or repair the damaged equipment, as well as other expenses incurred due to the damaged equipment.

Garage Liability Insurance

Garage Liability (aka Business Garage Insurance) protects members of the automobile industry from a variety of risks, including injuries, mistakes or property damage arising out of business operations.

Goods in Transit Insurance

Goods in Transit insurance covers items from theft, loss or damage while they are being transported from one place to another.

Hired and Non-Owned Automobile Insurance

Hired and Non-Owned Automobile Insurance provides liability coverage for property damage and bodily injuries caused by you or your employees while driving for work in vehicles that the business doesn’t own, such as rental vehicles and employees’ personal vehicles.

Installation Floater

Installation Floater coverage protects a contractors tools and materials from damages that can occur during a project, while they are not yet installed.

Product Liability Insurance

Product liability insurance protects again financial loss due to claims of injury and property damage resulting from the use of a product.

Professional Liability Insurance

Professional Liability Insurance is another name for Errors and Omissions Insurance.

Tool Floater

A Tool Floater covers tools used for business if they are lost or stolen.

Umbrella Liability Insurance

Umbrella Liability Insurance an be a great solution for a business that needs more liability coverage than what is offered in their General Liability, Employer’s Liability or Auto Liability Plan. Umbrella coverage can be purchased as a standalone policy or can be bundled with a General Liability policy.

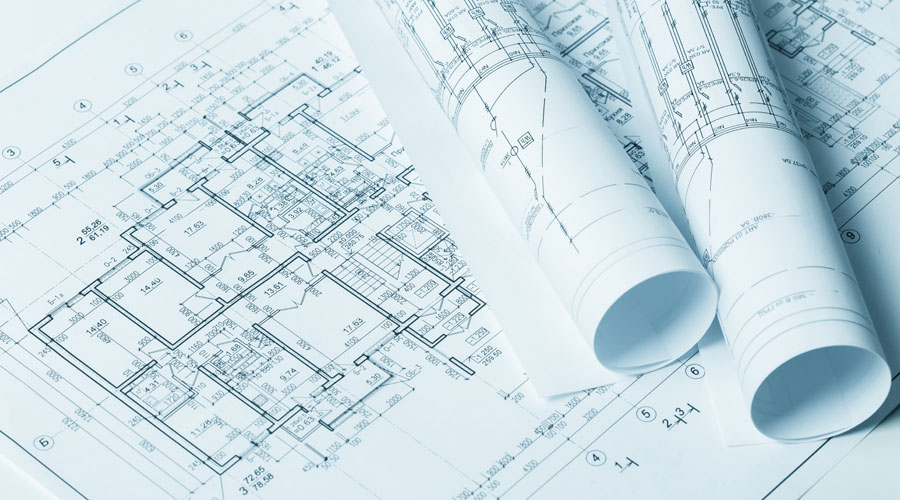

Valuable Papers and Records Insurance

Valuable Papers and Records Insurance covers the cost to repair or replace important documents such as blueprints or client files if they are damaged or destroyed.

Direct Compensation for Property Damage (DCPD) Insurance

DCPD is a mandatory coverage that applies to your not at-fault portion of a collision between two vehicles. If your vehicle is involved in a collision and you are not-at-fault, your vehicle damage will be paid for by your DCPD coverage. This is a new coverage in Alberta as of January 1, 2022.